ev tax credit 2022 california

What Is the New Federal EV Tax Credit for 2022. There is a federal tax credit of up to 7500 available for most electric cars in 2022.

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Every spring and fall millions of California residents receive credits on their electric and natural gas bills identified as the California Climate Credit The California Climate Credit is part of Californias efforts to fight climate change.

. The California Clean Fuel Reward is a California statewide electric vehicle time-of-sale. The credit amount will vary based on the capacity of the battery used to power the vehicle. 45 rows The following table shows the Federal tax credit and California CRVP rebate amount available for BEVs and PHEVs currently for sale in the US.

Federal Tax Credit Up To 7500. For instance California is generally known for providing good EV rebates to buyers and Texas offers a 2500 state rebate for buying an electric car. May 8 2022.

Auto sales will climb just 34 this year to 154 million cars and trucks as the semiconductor shortages continue to constrain vehicle inventory auto dealers predict. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. January 31 2022 by Peter McGuthrie California is lowering its MSRP limit and income cap for EV subsidies which offers 2000 USD for EVs and 1500 for plugin hybrids according to Green Car Reports.

For those that qualify Besides the generous credit for a LEVEL 2 home charger electric car owners can also qualify for a free HOV sticker. The EV rebate in California offers a huge incentive to drive electric vehicles - but its not the only one. At this time there are no federal EV rebates offered.

Bloomberg Bloomberg -- As the average price. The state has lowered its max MSRP limit for eligible EVs to 45000 from 60000 for passenger cars. Legislative history ab 113 horvath 20212022 would have provided under pitl and ctl a credit for 40 percent of the costs paid or incurred to the owners or developers of multifamily residential or nonresidential buildings for the installation of electric vehicle charging equipment in new construction additions and alterations to existing.

That being said California is giving credits to EV owners for an electric car home charger. Information specific to your state can be found on the US. Coltura is a registered.

Several months later it seems that revisions to the credit are returning to lawmaker agendas. 2021 Mustang Mach-E California Route 1 AWD RWD models EV. Note that the federal EV tax credit amount is affected by your tax liability.

Funds for this program may become exhausted before the fiscal year ends but applicants will be placed on a rebate waiting list in this case. Toyota is finally launching a mass-market battery-electric vehicle the bZ4X just as it is about to trigger a phase-out. For example if you purchase an EV eligible for 7500 but you owe only 4000 in taxes you will receive a 4000 credit.

State rebates will vary based on location. Department of Energys Federal and State Laws and Incentives page. A Ford dealership in Richmond California US on Wednesday Jan.

Southern California Edisons Pre-Owned EV Rebate Program offers customer a 1000 rebate for the purchase or lease of an eligible used EV. 500 per Level 2 or higher electric vehicle supply equipment installed during the taxable year and. Avoid the bothersome traffic jams of Los Angeles or Orange County by simply applying to get your HOV sticker.

Plug-in hybrids get 1000 battery-electric cars can get a 2000 rebate and hydrogen fuel-cell cars are eligible for 4500. President Bidens EV tax credit builds on top of the existing federal EV incentive. The exceptions are Tesla and General Motors whose tax credits have been phased out.

A qualified taxpayer would be allowed a credit of. Installation of specified electric vehicle supply equipment or direct current fast chargers or both in a covered multifamily dwelling or covered nonresidential building. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors.

2000 to 4500 for battery electric vehicles. This California EV rebate typically awards between 1000 and 3500 for plug-in hybrids. Get up to 7000 to purchase or lease a new plug-in hybrid electric vehicle PHEV battery electric vehicle BEV or a fuel cell electric vehicle FCEV.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. For example new EV purchasers may qualify for up to 750 in state tax credits in California in 2022 under the California Clean Fuel Reward program. Unlike the federal tax credit the California rebate comes in the form.

2022 C40 Recharge. These amounts are for Federal tax credits effective January 1 2020 and California CRVP rebates effective December 3 2019 when several changes were made to that program. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned.

Updated April 2022. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. At first glance this credit may sound like a simple flat rate but that is.

Learn all about EV incentives in 2022 and the difference between EV rebates and tax credits. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. The tax credit is also.

This incentive covers 30 of the cost with a maximum credit of up to 1000. Your reward will be listed on the lease or purchase agreementsimply look for a rebatenon-cash credits EV incentive manufacturer rebate or other line itembut it may be combined with. 2022 Electric California Climate Credit Schedule.

2022 California Clean Fuel Reward. And 4500 to 7000 for fuel cell electric vehicles. CVRP offers vehicle rebates on a first-come first-served basis and helps get the cleanest vehicles on the road in California by providing consumer rebates to reduce the initial cost of.

Did you know you might also qualify a 7500 federal tax credit for new all-electric vehicles.

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

.jpg)

Latest On Tesla Ev Tax Credit March 2022

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Toyota Buyers Soon Will Lose U S Electric Vehicle Tax Credits Los Angeles Times

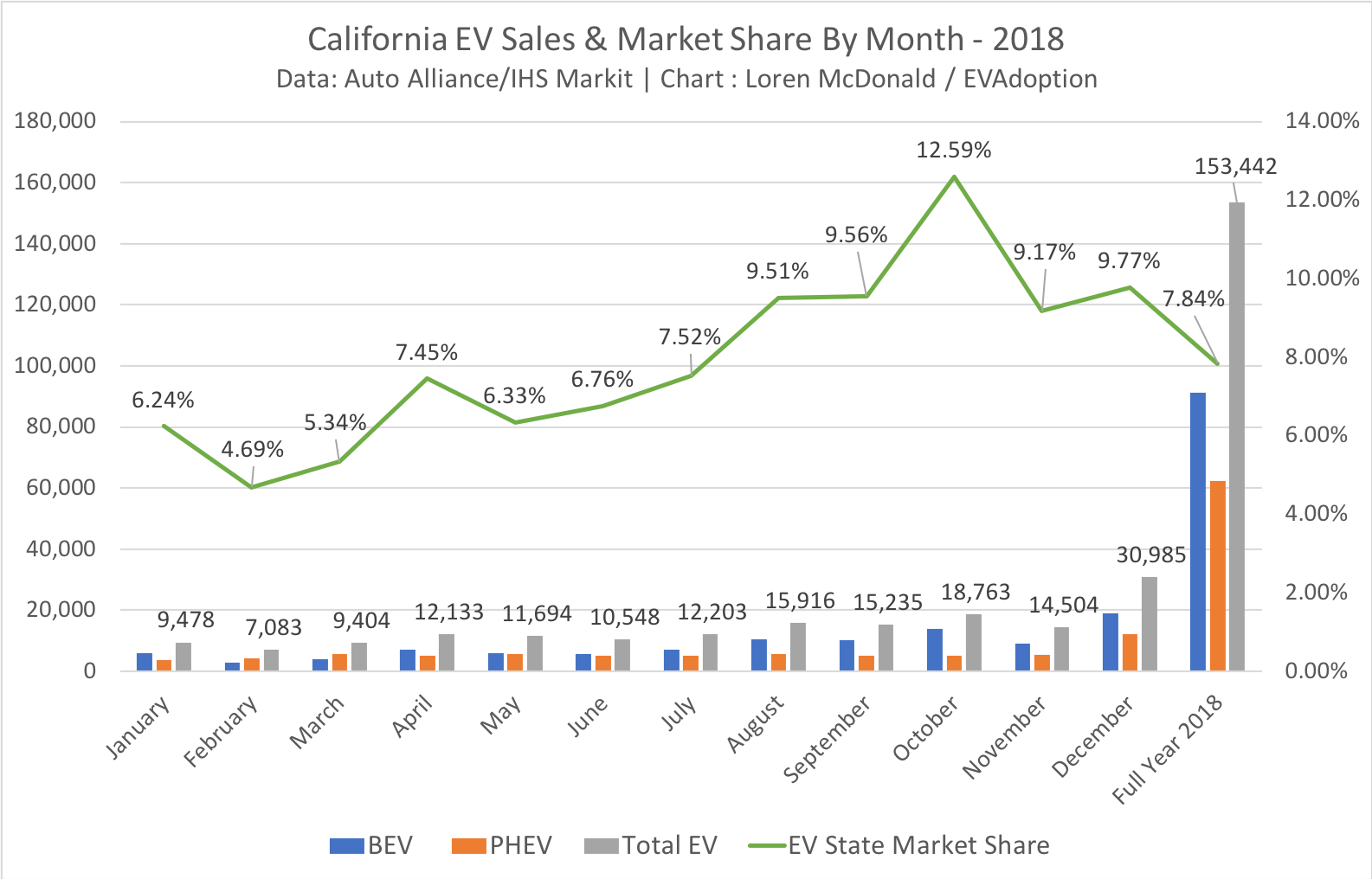

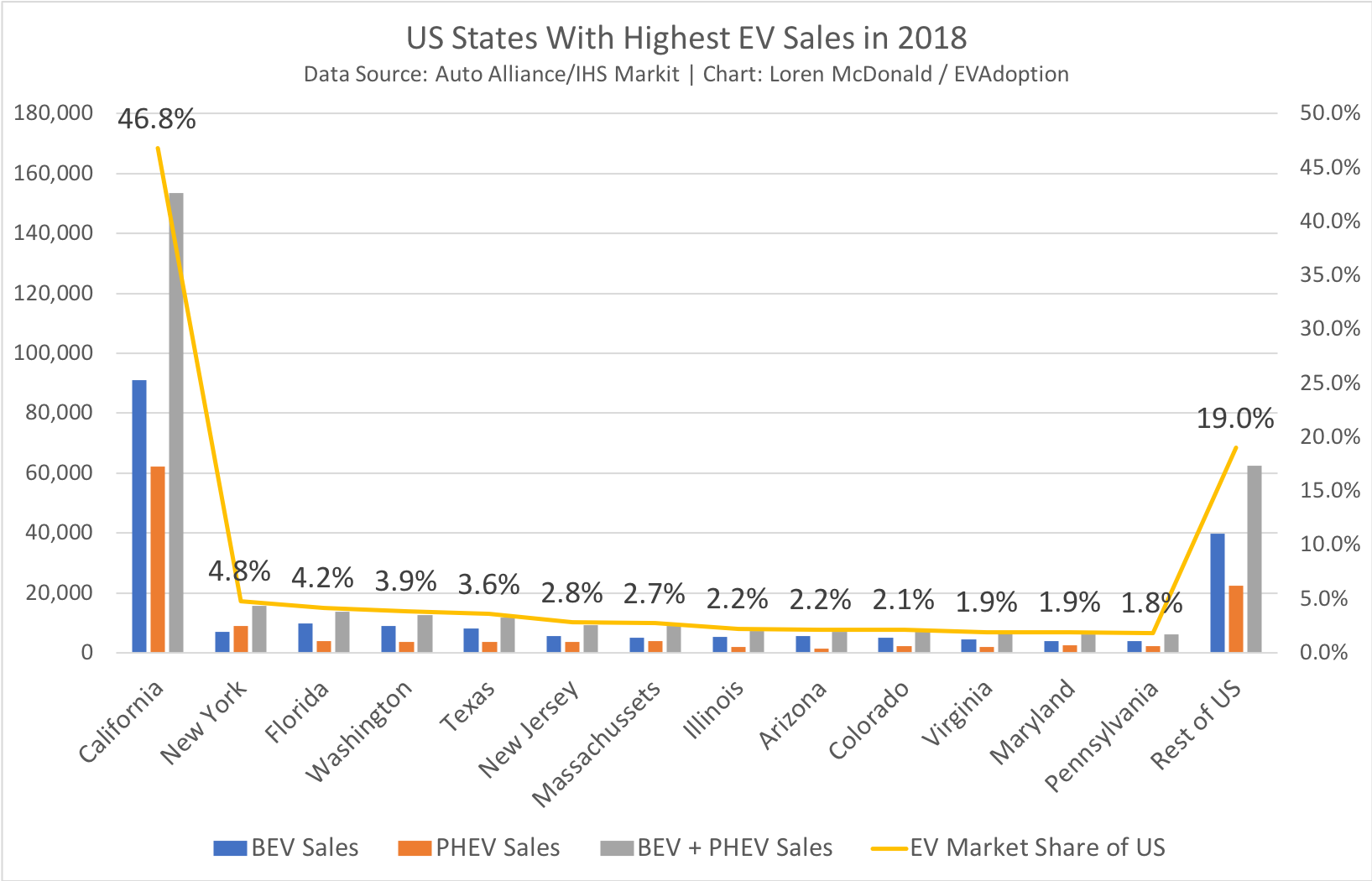

California Electric Vehicle Exports Already Valued At 3 Billion In 2018 Expected To Hit 3 4 Billion In 2019

Southern California Edison Incentives

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

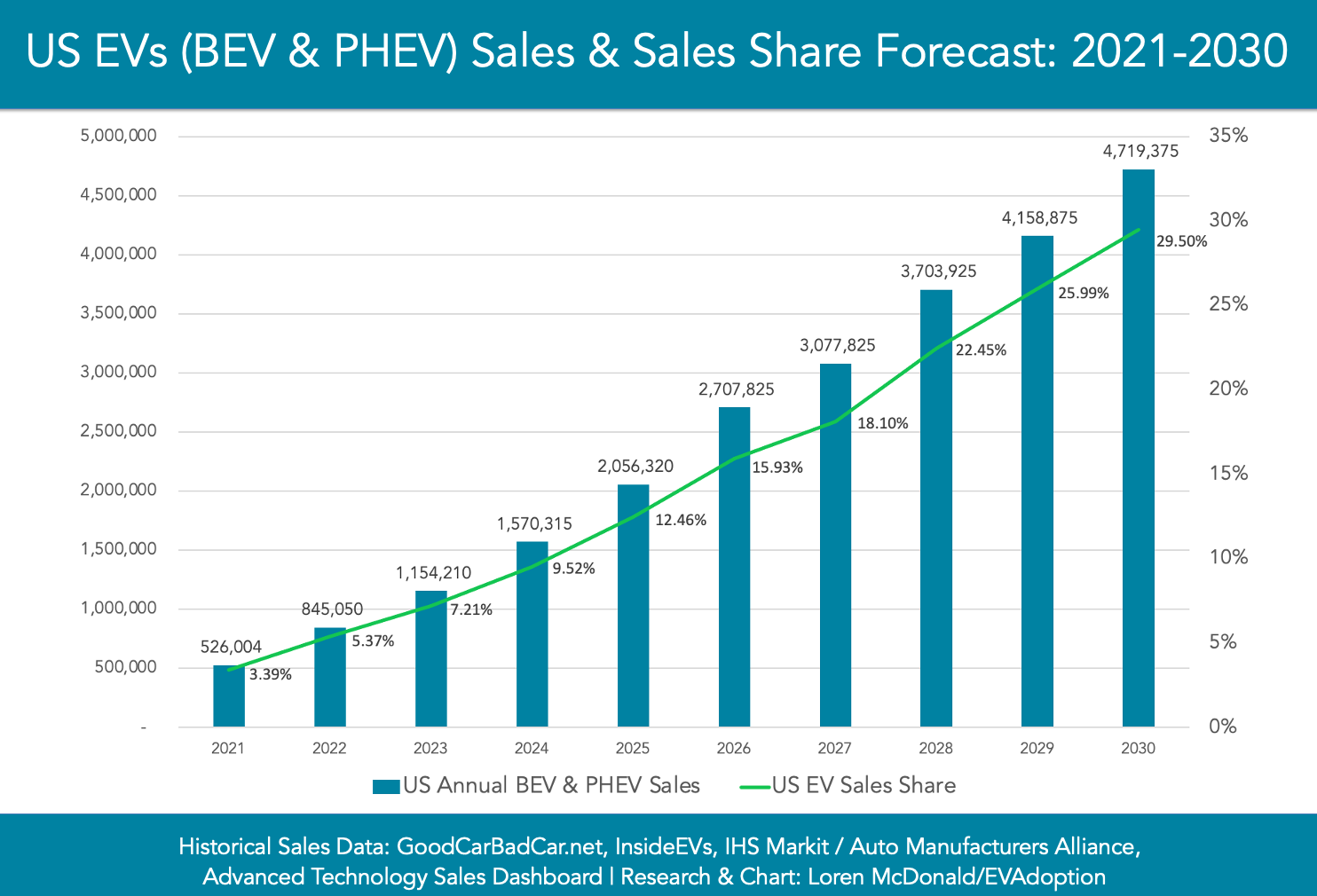

Ev Market Share California Evadoption

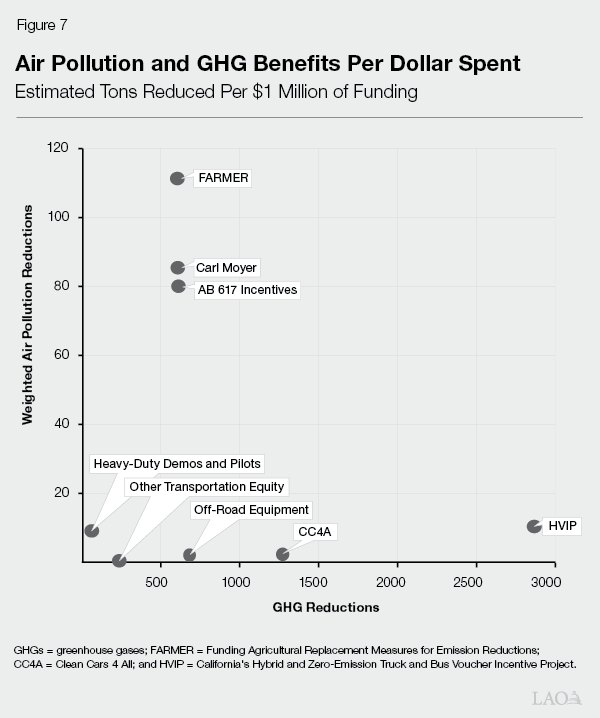

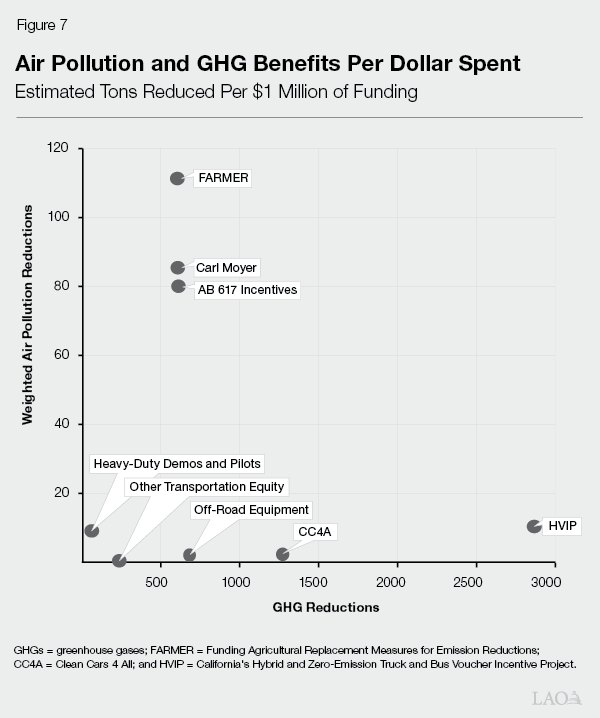

The 2022 23 Budget Zero Emission Vehicle Package

Ev Market Share California Evadoption

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

How Electric Vehicle Tax Credits Work